On november 3 2015 colorado springs voters approved a sales and use tax rate increase of 0 62 to fund road repair maintenance and improvements.

Auto sales tax in colorado springs.

The county sales tax rate is.

The 8 25 sales tax rate in colorado springs consists of 2 9 colorado state sales tax 1 23 el paso county sales tax 3 12 colorado springs tax and 1 special tax.

However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax.

The minimum combined 2020 sales tax rate for colorado springs colorado is.

The maximum tax that can be owed is 525 dollars.

For colorado springs residents the fact that 62.

This is the total of state county and city sales tax rates.

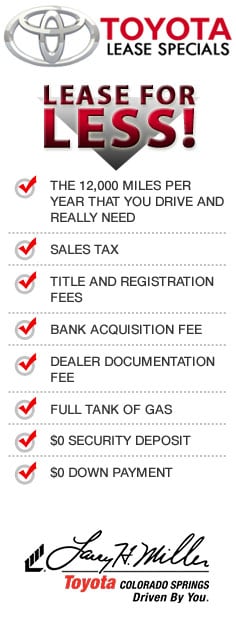

In addition to taxes car purchases in colorado may be subject to other fees like registration title and plate fees.

For tax rates in other cities see colorado sales taxes by city and county.

Putting this all together the total sales tax paid by colorado springs residents comes to 8 25 percent.

The colorado sales tax rate is currently.

On a 30 000 vehicle that s 2 475.

You can print a 8 25 sales tax table here.

The 0 62 road repair maintenance and improvements tax will expire five years from the date of implementation and will apply to all transactions that are currently taxable under the city sale sand use tax code.